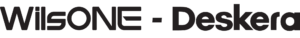

Deskera Finance

Manage financial processes like budgeting and forecasting, bank reconciliation and multi entity consolidation with ease. Gain visibility into financial performance, segment user roles, automatically generate financial reports, track payments, and easily forecast future financials.

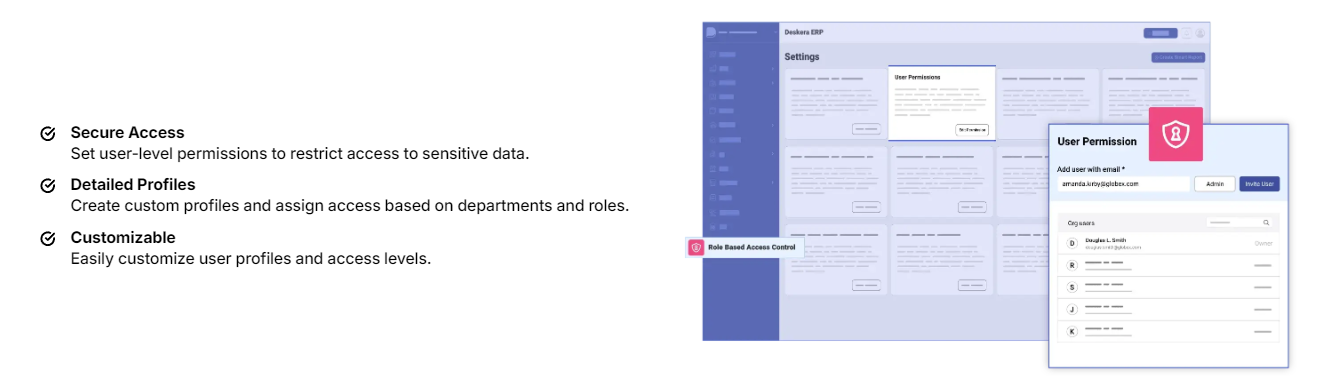

- Provide Role Based Access Control

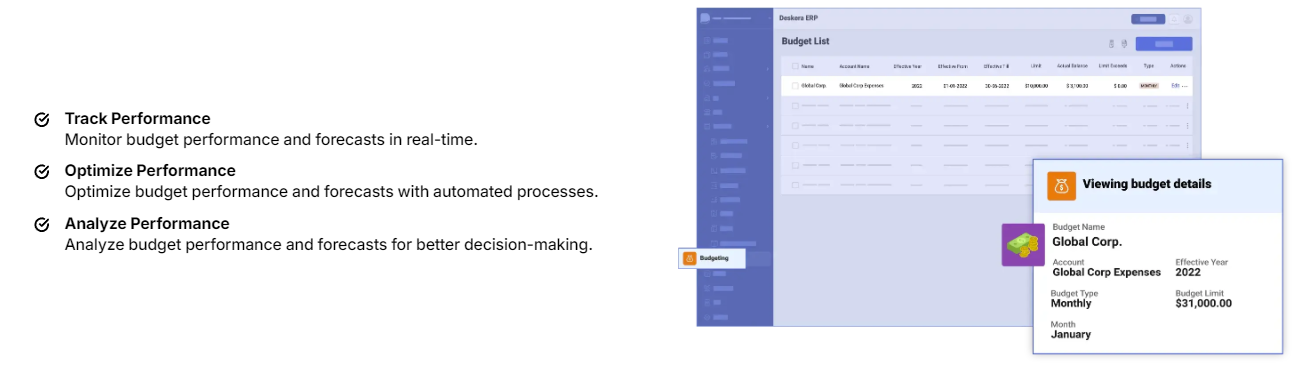

- Perform Budgeting and Forecasting

- Connect to Multiple Banks

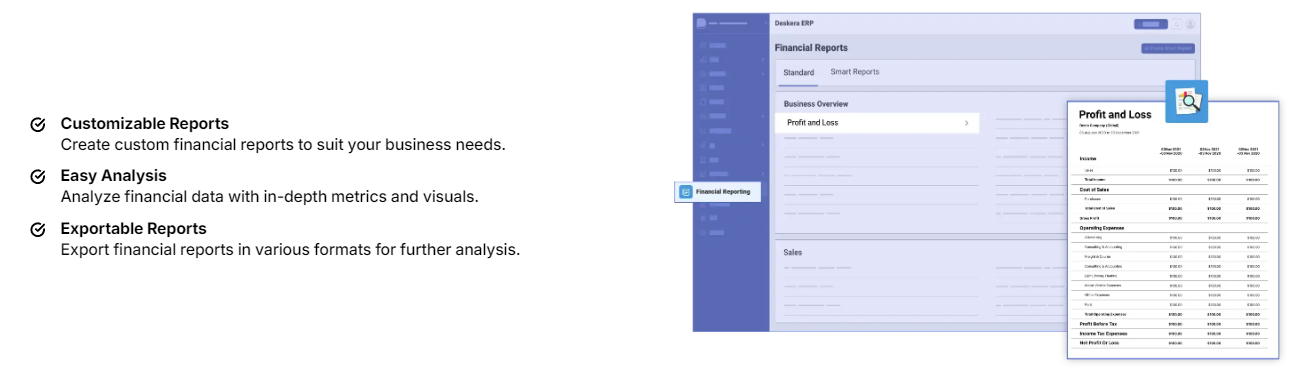

- Generate Financial Reports

- Integrate with Third-Party Applications

- Create Classes and Locations

- Set up Automations

- Consolidate Entities

- Track Cash Flows

- Automate Document Processing

- Utilize Custom Fields

- Reconcile Bank Accounts

- Implement Approval Workflows

- Monitor Performance with Key Performance Indicators

- Enable Auditing and Compliance

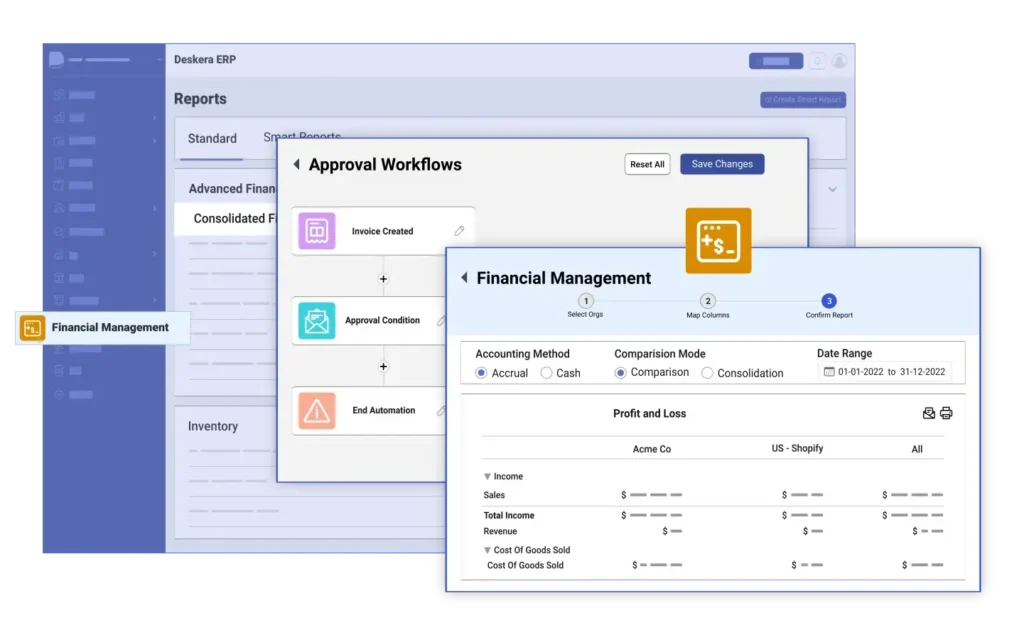

Deskera Finance for your business

Automations make it easier to record, monitor and analyze data, while Bank Reconciliation automates your bank reconciliation process. Multi-Entity Consolidation allows you to view, analyze and report on multiple entities in one dashboard. Approval Workflows help you keep track of financial approvals and Financial Reports enable you to quickly generate financial statements. With Deskera, you can take control of your finances.

Deskera ERP's Financial Management helps you tackle the complexities of managing your finances. With Role Based Access Control, you can set up who can access what information and features. You can classify your data with Classes and Locations and Custom Fields. With Budgeting & Forecasting, Deskera enables you to set your targets and plan for the future.

Questions? Answers.

Once you have registered the Sales and Service Tax, you will get your SST registration number. You are required to enter the Sales and Service Tax registration number when creating your organization in Deskera Books. In the compliance section when creating a new company, you’re required to enter your business registration number, the sales tax registration number, or service tax registration number, indicate if your company is eligible for the exemption, and lastly, select the exemption reason. Save the record of the company details.

With Deskera Books, under the Products module on the sidebar menu, when you’re creating a new product, you are required to fill in the fields as shown, especially the tariff code, default tax rate if your products are taxable, and if your products are non-taxable, indicate the exemption reason.

When you’re creating a new organization in the Deskera Book, you’re required to indicate if your business is registered for exemption. If yes, you’ll have to provide the exemption number, expiry date and indicate the exemption criteria that apply to you. Indicating the right exemption criteria enables our system to generate an accurate Report in compliance.

When you’re adding a contact in Deskera Books, you should come across the vendor type section . There are three options you can choose from when indicating the type of the vendor your contact’s . Indicating the right vendor type on Deskera Books during the creation of contact enables us to map the information accurately to the SST-02 Report .

With Deskera Books you are able to generate SST-02 Report, Sales Tax Return and Service Tax Return, which will help you to file your taxes on time.